Tuesday, July 31, 2007

Competing with the richest cricket organisation

The immense popularity of the game in India as well as the continuous growth of the Indian economy have armed BCCI with some of the most lucrative TV and sponsorship contracts in world sports.

The global media rights for international cricket to be held in India between March 2006 and March 2010 were awarded to production house Nimbus for a mind-boggling sum of US$612 Million.

The BCCI's membership generally includes the State cricket associations, though some states have more than one association. Maharashtra state, for instance, has Maharashtra cricket association, Mumbai Cricket Association and Vidarbha cricket association and Gujarat state has Gujarat cricket association, Baroda cricket association and Saurashtra cricket association. Railways and Services are also members.

Now the richest league BCCI is under threat, following the disappointment of Indian cricket fans with the poor performance of their cricket team in the World cup and the South African tour prior to that.

Indian team's failure in World Cup has led to lower earnings to Cricket broadcasters, advertisers, cricket sponsors and; tour operators. These defeats also caused massive disappointment to India's millions of fanatical cricket fans.

A new private cricket league, the Indian Cricket League (ICL) has been formed that will run parallel to the existing cricket league managed by Board of Control for Cricket in India (BCCI). The format of ICL will be Twenty20.

Australia's national cricket team captain, Ricky Ponting who is the highest ranked Test batsman and the highest ranked ODI batsman in the International Cricket Council, or ICC ratings has come out against the nascent ICL league.

"It's only a concern if there is huge money involved in it," Ponting said. "If this sort of stuff gets off the ground, these guys won't even be playing with their mates, they'll be thrown into made-up teams. You'll be out there by yourself and trying to win some money," he was quoted as saying by the Herald Sun.

Ponting's fear and apprehensions, while understandable is quite off the mark. Whether it is cricket or any other sport, it is the capitalist's big money that drives the game and motivates players. So having more competition cannot be bad for the game. If the ICI can poach contracted players of BCCI, it shows that ICCI is superior to BCCI. In a free market it bound to happen and it is part of the game.

The super star players who are under performing, yet having a cushy life are called to wake up.

Monday, July 30, 2007

Malaysian bloggers warned: Don't go overboard

The Malaysian prime minister has issued a fresh warning to bloggers, as a key ruling party member described cyberspace as having "the law of the jungle," a report said yesterday.

"For postings that insult (religion and the King), there are laws that can be used against the culprits," said Tan Sri Muhyiddin Yasin, who is also Agriculture and Agro-Based Industry Minister, after launching the four-day Malaysia International Machinery Fair 2007 at the Putra World Trade Centre yesterday.

Paris-based Reporters Without Borders (RSF) said bloggers have managed to create an unprecedented space for free expression in Malaysia.

Sunday, July 29, 2007

Charging to save the environment

This is green capitalism. Instead of adopting lifestyle changing habits, GE has unveiled a credit card designed to offset the environmental impact of the very consumerism it promotes.

GE Money's (GE) Earth Rewards MasterCard (MA) takes 1 percent of all purchases and uses the money to invest in greenhouse gas reduction projects like capturing methane, planting trees and building wind and solar power plants.

The Earth Rewards site lists "3 Easy Steps toward Reducing Your Climate Impact: 1. Choose Reward. 2. Shop. 3. Offset."

The malaise of US consumerism is an area that needs to be addressed as well.

Saturday, July 28, 2007

Courage and fortitude overcome loss of sight

On May 25, 2001, Erik Weihenmayer became the only blind man in history to reach the summit of the world's highest peak - Mount Everest.

Though there were questions about the wisdom of mountain climbing for a blind person, Erik never gave up on his dreams despite turning blind at the age of 13.

He believed that he deserved to live his best life. He is a passionate athlete, a former middle school teacher and wrestling coach.

Erik has become an accomplished mountain climber, paraglider, and skier, who has never let his blindness interfere with his passion for an exhilarating and fulfilling life.

Erik is the author of two books and appeared on several TV shows, gaining recognition for his achievements.

Erik's award winning film, Farther Than the Eye Can See, shot in the same stunning quality HDTV format as the 'Star Wars' prequels, was ranked in the top twenty adventure films of all time by Men's Journal.

Erik doesn't see himself as a reckless risk taker, he tries to do what he can possibly do, always trying to push himself to a higher level.

Erik's has become a motivational speaker who inspires people around the world, from Hong Kong to Switzerland, from Thailand to the 2005 APEC Summit in Chile.

He speaks to audiences on harnessing the power of adversity, the importance of teamwork and the daily struggle to pursue your dreams. Clearly, Erik's accomplishments show that one does not have to have perfect eyesight to have extraordinary vision.

Thursday, July 26, 2007

Lohan spiralling down on addiction

Lindsay Lohan was arrested early on Tuesday in Santa Monica, California, and released on bail for investigation of misdemeanour driving under the influence and with a suspended license, and felony cocaine possession.

“I am innocent... did not do drugs they’re not mine. I was almost hit by my assistant Tarin’s mom I appreciate everyone giving me my privacy,” Lohan wrote in an e-mail to Access Hollywood host Billy Bush, the show reported on its web site on Tuesday night.

Lindsay Lohan has joined a long list of young Hollywood celebrities who have battled alchohol and substance abuse. Many have recoverd through rehab and are enjoying sucessful careers while others died young feeding a deadly addiction.

Lohan's second DUI(driving under influence) has comes about while awaiting a conviction for her first charge of drunk driving. Again she is charged with drunk driving and carrying cocaine in her pocket.

David Deitch, an addiction specialist for more than 40 years and director of Phoenix House, a national nonprofit provider of substance-abuse treatments, said the glitter and glamour of Hollywood could be partly to blame. “That life is all about the excitement, drama and peak performance followed by a letdown that gets medicated with entertainment and medication,” he said.

Tuesday, July 24, 2007

Soft drinks are a health risk

That is because a soda habit increases the risk of developing a condition called metabolic syndrome, according to the new research, and that in turn boosts the chance of getting both heart disease and diabetes.

Metabolic syndrome is a cluster of symptoms that includes excessive abdominal fat, high blood-glucose levels, high blood pressure, high blood triglycerides and low levels of high-density lipoprotein, the "good" cholesterol.

People with three or more of these symptoms have double the normal risk of heart disease and diabetes.

Monday, July 23, 2007

Clinton visits Zambia

Since leaving office in 2001, Clinton has negotiated lower prices on AIDS drugs for poor countries in Africa and Asia, helping to extend tens of thousands of lives. The effort, however, is still hampered by overstretched facilities, stigma and an acute lack of skilled staff.

Zambia has put more than 93,000 HIV-positive people on anti-retroviral treatment over the last few years with help from the United States and other partners. But about 16 percent of the population is HIV-positive, and the country has a serious shortage of health care workers.

Clinton's first visit to Zambia was the third stop on an African tour that also took him to South Africa and Malawi. He was to fly to Tanzania on Sunday.

YouTube debates setting new trend

It is no longer a guy in a suit who mostly asks predictable questions of other suits in a carefully choreographed studio. The voter is a fixture in the audience, motionless until he or she gets to address the candidate, briefly and respectfully. It a is well designed PR stunt.

Now technology has come forward and is helping to change this old tradition. The debates still continue but the old world methods and the new world tactics have begun to overlap each other. In the new world, a kid in jeans and a T-shirt is asking questions, less reverentially, more pointedly and using powerful visual images to underscore the point.

The current presidential debates are about to enter the world of YouTube, the anything-goes home-video-sharing Web site that puts the power in the hands of the camera holder.

YouTube, which is owned by Google, and CNN are co-sponsoring a debate among the eight Democratic presidential candidates on July 23 in South Carolina, an event that could define the next phase of what has already been called the YouTube election, a visual realm beyond Web sites and blogs.

This proves that it is good for democracy when the people are empowered. Politicians often find that the people whose vote they need to come into office are much smarter than the political consultants and the men in grey suits( also known as spin doctors)- whether it is about Iraq war or global warming.

Friday, July 20, 2007

Internet destroying the reading culture!!!!

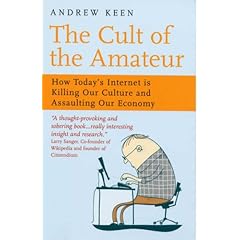

A review of Andrew Keen's 'The Cult of the Amateur' on Amazon by Jonathan Last, Online Editor, The Weekly Standard reads the following .

"In today's self-broadcasting culture, where amateurism is celebrated and anyone with an opinion, however ill-informed, can publish a blog, post a video on YouTube, or change an entry on Wikipedia, the distinction between trained expert and uninformed amateur becomes dangerously blurred.

When anonymous bloggers and videographers, unconstrained by professional standards or editorial filters, can alter the public debate and manipulate public opinion, truth becomes a commodity to be bought, sold, packaged, and reinvented."

The celebrated Web 2.0 interactive technology has now made media amateur experts out of anyone who can put out an opinion. In his view, Web 2.0 is changing the cultural landscape and not for the better.

Mr. Keen's pronouncement is strange for the present citizen journalism cannot be reversed. It is definitely a change for the better.

Mr. Keen says today's bloggers can't read and the Internet amateurs are destroying the reading culture. The truth is today's Internet generation reads differently, it can't be a bad thing. Only thing is the bloggers don't have to go through the gate keepers or the editorial boards of the mainstream news organisations. Bloggers don't have to satisfy news company bosses who sometimes twist and turn the truth before it gets published. Whatever content that is put out by the bloggers can be left for the readers to make their own decisions.

Thursday, July 19, 2007

A media mogul wins the crown jewel

Even before the deal is done, the American regulatory authority, the Securities Exchange Commission, SEC and the Justice Department have launched an investigation. As a wave of companies merge or seek to gain access to the public markets, SEC wants to ensure that trades are not done based on secret information.

SEC notified David Li, a Hong Kong banking magnate and Dow Jones board member, that it plans to recommend filing civil insider trading charges against him. These charges have come just as the merger entered its final phase.

Dow Jones' board has determined it will recommend to its stockholders, including the Bancroft family which holds shares representing a majority of Dow Jones' voting power, News Corp's proposal to acquire all of the outstanding shares of Dow Jones' stock for 60 usd per share cash, or a combination of cash and News Corp stock.

Critics of Murdoch- and he has as many bashers as supporters- argue that over half-century of his career as a journalist and businessman shows that his newspapers and other media outlets have made news coverage decisions that advanced the interests of his sprawling media conglomerate, News Corp.

In the process, Mr Murdoch has blurred a line that exists at many other US media companies between business and news sides — a line intended to keep the business and political interests of owners from influencing the presentation of news.

Tuesday, July 17, 2007

Brazil's soccer losing the samba

The Brazilians have won four of the last five Copa titles -- the exception was when Colombia won at home in 2001 -- and eight in all.

Argentina, the favourites to win had its top players and appeared unstoppable throughout most of the tournament. Brazil was missing the stars Ronaldinho and Kaka. The Brazilians edged Uruguay by 5-4 on penalty kicks in the semifinals after a 2-2 tie.

Brazil played the final with ruthless efficiency, the European concept that emphasizes the economics of efficiency to score goals.

Brazil's soccer is a spectacle of beautiful passing and flawless rhythm that resonates with the drum beat of the samba music famous in Brazil. This year Brazil has won the championship, but the beautiful game was missing.

The samba boys have won with a shrewd strategy. Brazil's coach Dunga, a defensive midfielder when he captained Brazil to World Cup glory in 1994, changed the system to employ three players in the holding role. The decision was controversial for a country used to the attack, attack, attack philosophy.

To Dunga what matters is the trophy. If this style continues, the beautiful game that has made Brazil so famous- even when they lose- will become a thing of the past.

Monday, July 16, 2007

The red hot debate over the raging bulls

How far can this bull market run before the bubble burst?

Many observers of global markets are asking this question.

The best is yet to come says Jim Rogers, George Soros' former right-hand man. "This bull market's got another 10 to 15 years to go."

A BBC article gives the results of a credit splurge, hard to ignore.

(1) UK house prices have doubled in the past 10 years.

(2) China's main stock index has quadrupled in value since the start of 2006.

(3) The UK's FTSE 100 and US S&P 500 stock indexes are at levels not seen in almost seven years.

(4) Commodity prices have been buoyed by strong global demand, pushing some such as copper to records.

(5) Merger and acquisition activity has taken off, and private equity firms are now in control of some of the world's biggest brands.

Financial pundits are gazing into crystal balls to determine the future trend of the raging bulls. Some speculate that oil price may be a determining factor. The US led campaign in Iraq, the pressure to pull out of Iraq and the tensions over Iran are factors closely being watched.

The red hot global economy is under nervous scrutiny.

Sunday, July 15, 2007

Reverse mortgage becomes a reward for US seniors

Looking at the aging population, reverse mortgage is a huge business and the lending community is eager to provide this special type of loan.

Though less than 2% of seniors have decided to turn the equity in their homes into cash by taking out a mortgage that pays them instead of the other way around, half of those reverse loans were written in the last two years.

Reverse mortgages, also known as home-equity conversion loans, enable homeowners age 62 or older to convert their equity into tax-free proceeds. The amount you can receive is based on the age of the youngest owner, the value and location of your home and current interest rates. Generally, the older you are, the more you can get.

For the US, the boomers are coming and they can get their houses to start paying them back.

Tuesday, July 10, 2007

Steve Prefontaine - America's greatest running legend

One of Prefontaine's most famous quotes given below is still vibrant in runners today.

Monday, July 09, 2007

Environmental call in global glitz

The promoter of this global extravaganza Al Gore, former US vice president hopes to spread awareness about our ailing planet. As international music stars lit up stages across the seven continents, international broadcasters of the 24-hour concert series was expected to reach 2 billion.

This global party is a desperately need act to wake up many still in slumber about the alarming damage to our environment caused by greenhouse gases and what action can be taken to reduce them.

Live Earth is a project of the SOS campaign , which is using a powerful multimedia platform - films, television, radio, Internet, books, wireless and others - to move people to combat the climate crisis.

Live Earth urged everyone to support a seven point initiative to reduce greenhouse gases.

(1) To demand United States join an international treaty within the next 2 years that cuts global warming pollution by 90% in developed countries and by more than half worldwide in time for the next generation to inherit a healthy earth;

(2) To take personal action to help solve the climate crisis by reducing my own CO2 pollution as much as I can and offsetting the rest to become 'carbon neutral;'

(3) To fight for a moratorium on the construction of any new generating facility that burns coal without the capacity to safely trap and store the CO2;

(4) To work for a dramatic increase in the energy efficiency of my home, workplace, school, place of worship, and means of transportation;

(5) To fight for laws and policies that expand the use of renewable energy sources and reduce dependence on oil and coal;

(6) To plant new trees and to join with others in preserving and protecting forests; and,

(7) To buy from businesses and support leaders who share my commitment to solving the climate crisis and building a sustainable, just, and prosperous world for the 21st century.

Friday, July 06, 2007

South African fruit picker faces British retail Giant

At the annual general meeting this year, while those at the top of the business are trying to persuade shareholders that Tesco chief executive Sir Terry Leahy should receive an extra £11m if its venture into the US succeeds, the 39-year-old single mother of three often does not have enough money to feed her children, let alone afford the prices that Tesco charges UK consumers for the fruit she picks.

Ms Baartman came to the company's annual meeting, thanks to ActionAid, an international anti-poverty agency, to plead with the board to pay her and her co-workers a living wage.

"Tesco should ensure that we have enough to live on. We are not asking for luxuries, just to be able to live without borrowing, and to respect the rights of women because we really work hard, they must give us what we deserve," she said yesterday.

The farm where she works supplies one of South Africa's largest fruit exporters, Capespan, which last year saw a 122% increase in profits after tax.

At Tesco's AGM this year, shareholders have been asked to support a resolution demanding that Tesco takes measures - to be independently audited - to ensure that workers "are guaranteed decent working conditions, a living wage, job security, freedom of association and of collective bargaining including ... the right to join a trade union of their choice".

This is a case of ethical trade in action. “Ethical trade” is an umbrella term for all types of business practices that promote more socially and/or environmentally responsible trade.

Tesco is a member of the ETI (Ethical Trading Initiative). Founded in 1998, the ETI aims to improve working conditions within a retailer's suppliers, through guidelines which members must incorporate into their codes of conduct. But the code is voluntary and members can be suspended or expelled only for non-compliance.

Wednesday, July 04, 2007

Blackstone buys Hilton

Blackstone's latest purchase is the Hilton Hotels Corp for about $US26 billion .

Under the terms of the agreement, Blackstone will acquire all the outstanding common stock of Hilton for $US47.50 dollars a share.

The price represents a premium of 40 per cent over Monday's closing stock price.

Hilton Hotels stock closed up 6.44 per cent yesterday on the New York Stock Exchange at $US36.05.

Hilton's board of directors approved the transaction. It would be completed sometime during the fourth quarter of 2007, subject to the approval of Hilton's shareholders, the corporation said in a statement.

The proposed transaction "will deliver substantial value creation for our shareholders. In addition, a majority of the equity will be owned by Canadians", Blackstone chairman Richard Currie said.

Hilton is a company that took 40 years to be reunited as a single entity, following the $6bn merger of Hilton Hotels Corporation with its UK sister, Hilton Inter- national in 2005.

For the family of Conrad Hilton, the deal represents the culmination of a hotel empire growth story that has lasted nearly 90 years.

Blackstone's step into the public limelight marked a sea change for an industry that had closely guarded its secrecy. Blackstone was previously a wholly private partnership and as such under US laws not subject to the same scrutiny as public corporations.

Blackstone's IPO launch and the deal with Hilton Hotels mark a heady year for Blackstone.

Monday, July 02, 2007

Revisiting the Asian financial crisis

It is January 15 1998. The photo on the right of Indonesia's president Suharto signing away his power to an IMF bail out package of $ 33 billion is a powerful image; one that was witnessed by a stern-faced Michel Camdessus, the IMF managing director and a anxious nation watching on national television.

This July marks the 10th anniversary of East Asia's financial crisis. In July 1997, the Thai baht plummeted. Soon after, financial panic spread to Indonesia and South Korea, then to Malaysia. In a little more than a year, the Asian financial crisis became a global financial crisis, with the crash of Russia's ruble and Brazil's real.

Mr Suharto of Indonesia had no choice but to agree to severe austerity measures. In the space of less than a year, annual per-capita income has fallen from $1,200 to $300 and stock market values from $118 billion to $17 billion. Only 22 of Indonesia's 286 publicly listed companies are considered solvent.

According to official estimates, nearly two million Indonesians lost their jobs, including about 500,000 workers in the textile industry. The state-run labor union has estimated that the unemployment rate could reach 11 percent of the country's estimated work force of more than 90 million. Many more will be underemployed.

Public anger and frustration that followed, soon saw a violent end to Suharto's iron-fisted regin of 31 years.

Then, the IMF and the US Treasury blamed the crisis on a lack of transparency in financial markets.

But when developing countries pointed their fingers at secret bank accounts and hedge funds, IMF and US enthusiasm for greater transparency diminished. Since then, hedge funds have grown in importance, and secret bank accounts have flourished.

Some similarities exist between the situation then and today. Before the 1997 crisis, there had been rapid increases in capital flows from developed to developing countries -- a six-fold increase in six years. Afterward, capital flows to developing countries stagnated.

Before the crisis, some thought risk premia for developing countries were irrationally low. These observers proved right: The crisis was marked by soaring risk premia. Today, the global surfeit of liquidity has once again resulted in comparably low risk premia and a resurgence of capital flows, despite a broad consensus that the world faces enormous risks (including the risks posed by a return of risk premia to more normal levels.)

It seems in the very nature of capitalism there will be ups and downs in the markets; therefore some crises is bound to lurk around the corner. The ability to always anticipate change, religiously follow market trends and be ever ready to react would be the order of success in this financial game.